Early Stage Growth Fund

Quick Facts

| Investor | Institutional | |

| Ticker: | BUFOX | BUIOX |

| Daily Pricing: | ||

| As of 4/24/2024 | ||

| NAV: | $15.37 | $15.49 |

| $ Change: | $-0.02 | $-0.03 |

| % Change: |

-0.13% | -0.19% |

| YTD: |

-0.32% | -0.32% |

| Inception Date: | 5/21/2004 | 7/1/2019 |

| Expense Ratio: | 1.50% | 1.35% |

| Total Net Assets: | $78.20 Million (3/31/24) | |

| Morningstar Category: | Small Cap Growth | |

| Benchmark Index: | Russell 2000 Growth | |

|

Related Material: Fund Fact Sheet Q1 2024 PM Commentary Q4 2023 |

||

Recent Media Coverage

- Kiplinger Top-Performing Mutual Fund (10 Years) – August 18, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – July 28, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – June 17, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – May 13, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – April 22, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – March 23, 2021

- Investor’s Business Daily 2021 Best Mutual Funds Award Winner – March 22, 2021

- Kiplinger Top-Performing Mutual Fund (10 Years) – January 19, 2021

Fund Objective & Investment Process

The investment objective of the Buffalo Early Stage Growth Fund is long-term growth of capital. The Fund invests primarily in equity securities, consisting of common stocks, preferred stocks, convertible securities, warrants and rights, of companies that, at the time of purchase by the Fund, are defined as early stage growth companies. Early stage growth companies are defined by the Fund as companies that, at the time of purchase by the Fund, have market capitalizations below the median of the Russell 2000 Growth Index and are companies that are starting to develop a new product or service or have recently developed a new product or service.

The Fund managers seek to identify companies for the Fund’s portfolio that are expected to experience growth based on the identification of long-term, measurable secular trends, and which, as a result, may have potential revenue growth in excess of the gross domestic product growth rate. Companies are screened using in-depth, in-house research to identify premier early-stage growth companies which generally demonstrate:

- Strong management teams

- Little or no debt

- Potential for increasing free cash flow

- Scalable business models with a competitive advantage

- Potential for increasing margins

- Attractive risk/reward given the market framework

We believe investing in an actively-managed portfolio of premier, early-stage, growth companies could lead to growth of capital over time. We look for companies that could benefit from long-term industrial, technological, or general market trends, and are trading at what we view as attractive valuations.

Craig Richard, Portfolio Manager

Morningstar Rating

Overall Morningstar Rating™ of BUFOX based on risk-adjusted returns among 552 Small Growth funds as of 3/31/24.

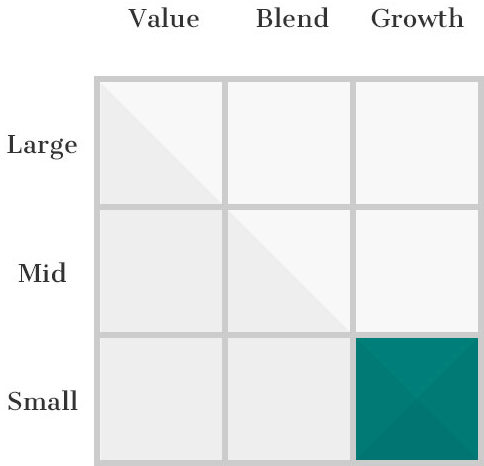

Investment Style

Performance (%)

| As of 3/31/24 | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 15 YR | Since Inception |

|---|---|---|---|---|---|---|---|---|

| BUFFALO EARLY STAGE GROWTH FUND - Investor | 4.80 | 4.80 | 7.38 | -7.24 | 7.79 | 7.19 | 15.61 | 8.41 |

| BUFFALO EARLY STAGE GROWTH FUND - Institutional | 4.83 | 4.83 | 7.45 | -7.10 | 7.94 | 7.34 | 15.78 | 8.57 |

| Russell 2000 Growth Index | 7.58 | 7.58 | 20.35 | -2.68 | 7.38 | 7.89 | 13.39 | 8.84 |

| As of 3/31/24 | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 15 YR | Since Inception |

|---|---|---|---|---|---|---|---|---|

| BUFFALO EARLY STAGE GROWTH FUND - Investor | 4.80 | 4.80 | 7.38 | -7.24 | 7.79 | 7.19 | 15.61 | 8.41 |

| BUFFALO EARLY STAGE GROWTH FUND - Institutional | 4.83 | 4.83 | 7.45 | -7.10 | 7.94 | 7.34 | 15.78 | 8.57 |

| Russell 2000 Growth Index | 7.58 | 7.58 | 20.35 | -2.68 | 7.38 | 7.89 | 13.39 | 8.84 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| BUFFALO EARLY STAGE GROWTH FUND - Investor | 61.70 | -7.38 | -9.41 | 11.05 | 27.18 | -3.95 | 34.03 | 47.69 | 7.79 | -30.76 |

| BUFFALO EARLY STAGE GROWTH FUND - Institutional | 61.94 | -7.24 | -9.28 | 11.22 | 27.37 | -3.81 | 34.20 | 47.96 | 7.94 | -30.66 |

| Russell 2000 Growth Index | 43.30 | 5.60 | -1.38 | 11.32 | 22.17 | -9.31 | 28.48 | 34.63 | 2.83 | -26.36 |

| Morningstar U.S. Small Growth Index | 41.86 | 2.46 | -0.18 | 9.61 | 23.77 | -5.67 | 27.60 | 43.52 | -1.00 | -33.31 |

3 Year Risk Metrics

| BUFOX vs Russell 2000 Growth Index (As of 3/31/24) | |

|---|---|

| Upside Capture | 85.92 |

| Downside Capture | 103.45 |

| Alpha | -4.78 |

| Beta | 0.95 |

| Sharpe Ratio | -0.46 |

Hypothetical Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on the Inception Date. Assumes reinvestment of dividends and capital gains. This chart does not imply future performance.

Portfolio

Portfolio Characteristics

| (As of 3/31/24) | |

|---|---|

| # of Holdings | 59 |

| Median Market Cap | $1.46 B |

| Weighted Average Market Cap | $3.04 B |

| 3-Yr Annualized Turnover Ratio | 21.95% |

| % of Holdings with Free Cash Flow | 72.88% |

| Active Share | 95.12% |

Top 10 Holdings

| Holding | Ticker | Sector | % of Net Assets |

|---|---|---|---|

| Compass Diversified Holdings | CODI | Financials | 3.18 |

| Bowman Consulting Group, Ltd. | BWMN | Industrials | 3.17 |

| Hamilton Lane Incorporated Class A | HLNE | Financials | 3.11 |

| Transcat, Inc. | TRNS | Information Technology | 3.10 |

| Calix, Inc. | CALX | Information Technology | 2.95 |

| ICF International, Inc. | ICFI | Industrials | 2.86 |

| Varonis Systems, Inc. | VRNS | Information Technology | 2.75 |

| NV5 Global Inc | NVEE | Industrials | 2.56 |

| Cadre Holdings, Inc. | CDRE | Industrials | 2.54 |

| Federal Signal Corporation | FSS | Industrials | 2.52 |

| TOP 10 HOLDINGS TOTAL | 28.75% | ||

Sector Weighting

As of 3/31/24. Security weightings are subject to change and are not recommendations to buy or sell any securities. Sector Allocation may not equal 100% due to rounding.

Market Capitalization

As of 3/31/24. Market Cap percentages may not equal 100% due to rounding.

Management

Commentary

PERFORMANCE COMMENTARY

(As of 12/31/23) —

The Buffalo Early Stage Growth Fund generated a return of 9.75% for the quarter

compared to the Russell 2000 Growth Index return of 12.75% during the period.

For calendar year 2023, the fund returned 9.83%. Small caps trailed their large cap

counterparts significantly in 2023 with the Russell 1000 Growth (Large Cap) Index leading

the way up 42.68%, the Russell Midcap Growth Index advanced 25.87% and the Russell

2000 Growth (Small Cap) climbed 18.66%. Further on down the market cap spectrum, the

Russell Microcap Growth Index produced a return of 9.11% in 2023.

The fund is positioned at the smaller end of the small cap spectrum as measured by the

portfolio’s weighted average market cap. This presented a consistent headwind in 2023

given the underperformance of smaller companies in the index.

On a sector basis, the fund underperformed in both the Healthcare and Technology sectors

in the quarter. This was partially offset by outperformance in the fund’s Industrials holdings.

In terms of individual stock detractors in the quarter, Establishment Labs again

represented a material contributor to underperformance in the quarter. Establishment

Labs (ESTA) is a long-time holding of the fund that came under significant pressure

in the second half of calendar 2023. The company is an innovator in the Healthcare

sector, bringing innovation to the breast augmentation and reconstruction space that has not had material innovation for close to 20 years. The company is currently in 80

countries, establishing leading market shares of greater than 30%, and most importantly,

has a superior safety profile to legacy breast implant manufacturers. The incremental

pressure on the shares in the quarter was due to significant slowing of demand for breast

augmentation procedures in foreign geographies. Over half of all revenue comes from

distributors who serve plastic surgeon practices. As the consumer showed some signs of

weakness and economic conditions tightened, distributors put the brakes on orders and

started to draw down existing inventories versus continuing to replenish. Additionally, the

approval of the company’s breast implants into the Chinese market remained delayed. The

shares have rallied in early 2024 on the news of approval to enter the Chinese market and

indications that distributor inventory destocking is behind them. Additionally, investors are

refocused on the pending approval to enter the U.S. market which represents over half

the global opportunity.

Kinsale Capital Group was another large individual drag to performance during the

quarter. Kinsale is a specialty insurer focused solely on excess and surplus (E&S) lines.

Gross premiums written grew 34% in the third quarter, which disappointed investors

who had become accustomed to growth in the 40%s and 50%s. While the business will

inevitably show signs of cyclicality over time, we expect the company’s technology platform

and focus on E&S policies will allow them to continue to outperform in the segment. Kinsale enjoys a significant cost advantage over its peers which should allow it to continue

to capture market share. In the E&S space, Kinsale has a 1-2% market share and continues

to grow aggressively with the largest players in the space having 15% market share. There

remains plenty of runway to allow Kinsale to continue to grow at an attractive rate as

the E&S market continues to grow as a percentage of the overall property and casualty

insurance marketplace.

On the positive side, Shift4 Payments was a recent addition to the Fund in the fourth

quarter that performed well and was one of the top individual contributors. Shift4

is an integrated payments company with a legacy of providing payment solutions

to the hospitality sector (hotels/restaurants). They have expanded into professional

sports venues and are near agreements to launch ticketing solutions to go along with

concessions. Additionally, they are just beginning international expansion through a recent

acquisition. Along with delivering strong growth in the third quarter, the shares were

bolstered by potential takeout interest given what we felt was a disconnect between the

valuation and the results the company has been producing

OUTLOOK

(As of 12/31/23) —

While the employment environment remains strong, excess household savings

accumulated during the pandemic are closer to being exhausted. In the fourth quarter,

the Fed signaled a more dovish outlook and paused its aggressive interest rate hikes

that began in March of 2022. As a result, small cap stocks experienced a sharp rebound

intra fourth quarter with the Russell 2000 Growth Index rising approximately 25% from

late October through the calendar year end.

As the economy shows continuing signs of growth and the Fed moves to a position of

lowering interest rates and halts quantitative tightening, we are becoming increasingly

more positive on the outlook for small cap stocks. Valuation levels of small caps relative

to large caps remain at historically attractive levels. Additionally, the performance gap

between small cap stocks and large cap stocks remains wide relative to historical levels,

and we believe this performance gap will compress.

Our job remains to find and hold attractive small cap companies that have not been fully

appreciated by the market or are mispriced due to recent results or events. We believe

less investor interest in this segment of the market creates an opportunity for us to

uncover value over the long term.

The fund typically invests at the smaller end of the small cap growth spectrum and the

managers continue to seek companies with sustainable growth due to secular growth

trends or innovative, disruptive products. The Buffalo Early Stage Growth Fund is

focused primarily on identifying innovation within U.S. companies with primarily North

American revenue bases. With an active share of greater than 90%, a lower turnover

strategy with 50-70 holdings, the fund aims to continue to offer a distinct offering from

the Index and category peers.

The opinions expressed are those of the Portfolio Manager(s) and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. Earnings growth is not representative of the fund’s future performance.

Literature

| Buffalo Early Stage Growth Documents | Last Updated |

|---|---|

| Fact Sheet | 3/31/24 |

| Quarterly Commentary | 12/31/23 |

| Full Fund Holdings | 6/30/23 |

| Prospectus | 7/28/23 |

| Statement of Additional Information | 7/28/23 |

| Annual Report | 3/31/23 |

| Semi-Annual Report | 9/30/22 |

| Tax Guide - 2023 | 1/8/24 |

Fundamental Approach

We get to know the companies we invest in and learn how they run their business.

Top-Down & Bottom-Up

We identify Top-Down broad, secular growth trends and search for companies from the Bottom-Up.

Proprietary Philosophy

We construct our portfolios based on our own proprietary investment strategy.

Disciplined Investing

Sticking to our disciplined investment strategy ensures we maintain a consistent, balanced approach.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

The Buffalo Early Stage Growth Fund (BUFOX) received 2 stars among 552 for the three-year, 2 stars among 520 for the five-year, and 2 stars among 400 Small Growth funds for the ten-year period ending 3/31/24.